Offer Comprehensive Services

Al Ahly Pharos Securities Brokerage division plans to increase its market share among retail, high-net-worth clients and foreign clients, continuing to provide them an unparalleled level of brokerage services in the Egyptian market

Transaction Value (EGP)

Transaction Value (EGP)

Transaction Value (EGP)

Transaction Value (EGP)

Transaction Value (EGP)

Transaction Value (EGP)

Research and Analytics

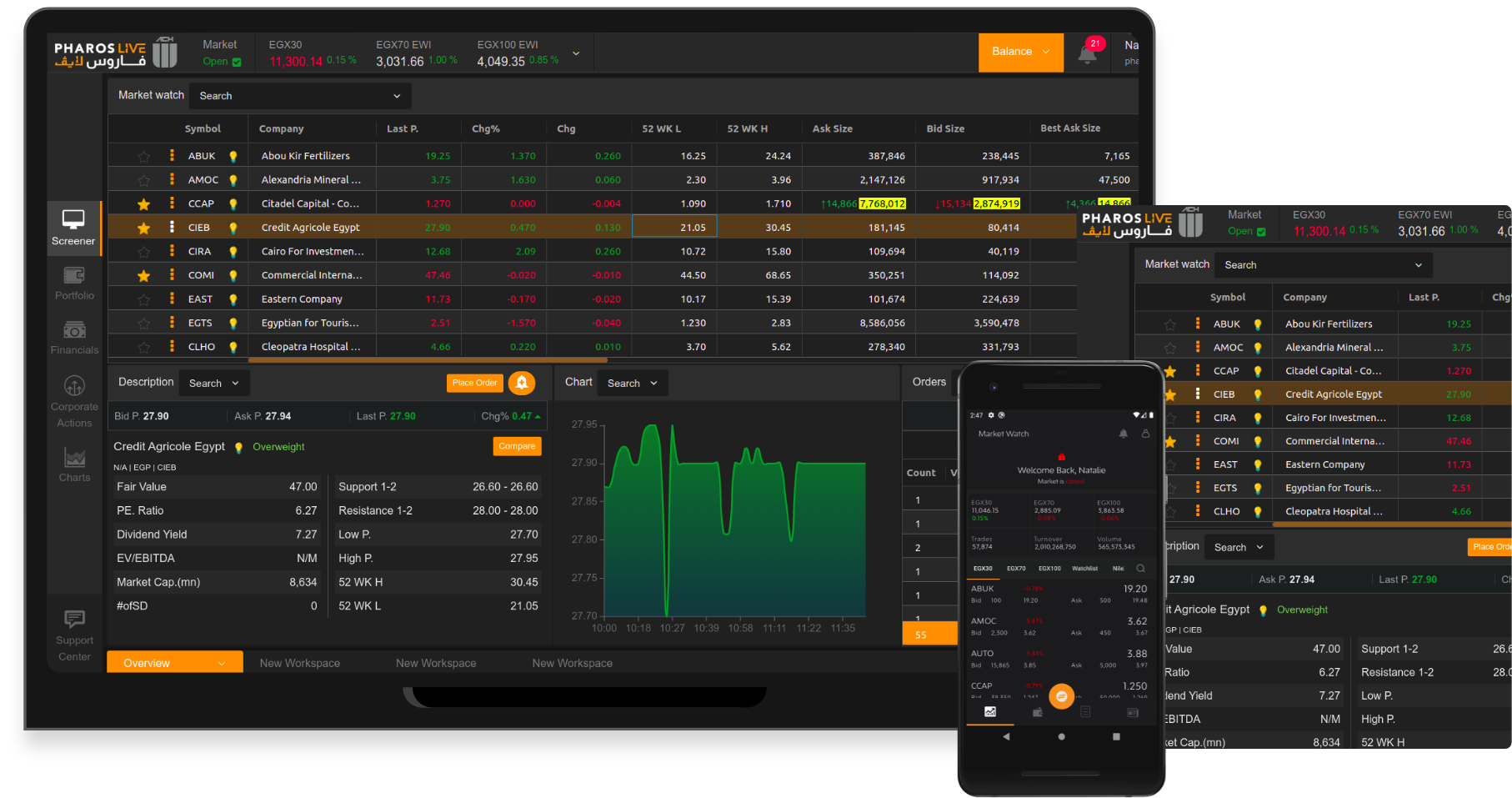

Pharoslive

Today's Trading, Tomorrow's Technology

INVESTMENT BANKING

Looking ahead, Al Ahly Pharos Investment Banking remains committed to driving growth and creating value for its clients. With a focus on the deep understanding of Egypt’s dynamic market, the division is well-positioned to continue shaping the future of investment banking in the region.

Landmark Transactions

- Private Placement Abu Qir

- 2022

- ROLE

- Transaction Execution Broker

- OFFERING

- 272 Mn shares

- BUYER TYPE

- Block sale

- EXCHANGE

- Egyptian Exchange

- Private Placement Commercial International Bank

- 2022

- ROLE

- Transaction Execution Broker

- SUBSCRIPTION

- 340 Mn shares

- BUYER TYPE

- Block sale

- EXCHANGE

- Egyptian Exchange

- Private Placement Fawry for Banking Technology and Electronic Payments

- 2022

- ROLE

- Transaction Execution Broker

- BUYER

- 215 Mn shares

- BUYER TYPE

- Block sale

- PROCESS

- Egyptian Exchange

- Private Placement Fawry for Banking Technology and Electronic Payments

- 2022

- ROLE

- Transaction Execution Broker

- BUYER

- 202 Mn shares

- BUYER TYPE

- Rights Issue

- PROCESS

- Egyptian Exchange

- Private Placement MOPCO

- 2022

- ROLE

- Transaction Execution Broker

- OFFERING

- 46 Mn shares

- BUYER TYPE

- Block sale

- EXCHANGE

- Egyptian Exchange

- Private Placement Alexandria Container Handling

- 2022

- ROLE

- Transaction Execution Broker

- OFFERING

- 477 Mn shares

- BUYER TYPE

- Block sale

- EXCHANGE

- Egyptian Exchange

- Follow-on Offering Abu Qir

- DECEMBER 2021

- ROLE

- Joint Bookrunner

- OFFERING

- 10% of ABUK Shares

- SECONDARY

- Secondary

- EXCHANGE

- Egyptian Exchange

- Initial Public Offering- IPO 24%

- (OCTOBER 2021)

- ROLE

- Co-Lead Manager

- SUBSCRIPTION

- 90% Institutional 10% Retail

- IPO TYPE

- Primary Offering

- EXCHANGE

- Egyptian Exchange

- Divesture of 100%

- (JULY 2021)

- ROLE

- Exclusive Sell-Side Advisor

- BUYER

- BUYER TYPE

- Strategic Investor

- PROCESS

- Competitive Sale Process

- Divesture of 24%

- (DECEMBER 2020)

- ROLE

- Exclusive Sell-Side Advisor

- BUYER

- BUYER TYPE

- Financial Investor

- PROCESS

- Competitive Sale Process

- Divesture of 100%

- (MAY 2020)

- ROLE

- Financial Advisor

- BUYER

- BUYER TYPE

- Global Strategic

- PROCESS

- Egyptian Exchange

- Divesture of 100%

- (JULY 2019)

- ROLE

- Exclusive Sell-Side Advisor

- BUYER

- BUYER TYPE

- Financial Investor

- PROCESS

- Competitive Sale Process

- Initial Public Offering - IPO 24%

- (DECEMBER 2017)

- ROLE

- IPO Sole Co-ordinator & Bookrunner

- SUBSCRIPTION

- 75% Institution 25% Retail

- IPO TYPE

- Secondary Offering

- EXCHANGE

- Egyptian Exchange

- Follow-on Offering Telecom Egypt

- 2023

- ROLE

- Joint Global Coordinator and Bookrunner

- OFFERING

- 170.7 Mn shares

- DEAL TYPE

- Secondary Offering

- EXCHANGE

- Egyptian Exchange

- MTO Pachin

- 2023

- ROLE

- Sell-Side Advisor for Chemical Industries Holding Company

- OFFERING

- 19.4 Mn shares

- DEAL TYPE

- MTO

- Exchange

- Egyptian Exchange

- Debt Raising KIMA

- 2024

- ROLE

- Exclusive Financial Advisor

- LENDER

- Group of Banks

- LENDER TYPE

- Local Institutions

- PROCESS

- Negotiated Terms

- Divesture of 25% Al Ahly Momkn

- 2024

- ROLE

- Exclusive Sell-Side Advisor

- BUYER

- e-Finance

- BUYER TYPE

- Local Strategic

- PROCESS

- Competitive Sale Process

- Divesture of 51% Easy Lease

- 2024

- ROLE

- Exclusive Sell-Side Advisor

- BUYER

- Al Ahly Capital

- BUYER TYPE

- Financial Investor

- PROCESS

- Negotiated Sale

Al Ahly Pharos Investment Banking will continue to expand the scope and standards of its services to offer comprehensive solutions to its clients that are unrivaled in the region, growing to become the top investment bank in Egypt

ASSET MANAGEMENT

AFIM Market Share (%)

AFIM’s positioning in the market combined with the backing of the NBE will enable ACH to leverage the bank’s expansive branch network as well as enhance operational synergies across the entirety of the company, creating an investment powerhouse and offering clients a consolidated scope of services